No this is not mandatory. The only obligation you have, and not the least, is to remain in compliance with the law and be able to pay the salaries, social charges (NPF, NSF, Levy) and restitution to the MRA of the income tax (PAYE system: Pay As You Earn) that you withheld from the employee; but also, to be able to justify it in case of control, to show how you constituted these elements.That's when you'll need software in particular.Payroll Mauritius logs month by month, all the elements that contributed to the development of your payroll. Thus you can find, even years later, the rates that were used to pay such expense, or the hours worked by such employee, or such exceptional bonus paid, with the withholding rates in force. But above all, you can instantly prepare your pay for the month since the rates are up to date and all you need to do is enter any absences of your employees.

The answer to this question is... unlimited. As long as you are a subscriber, Payroll Mauritius keeps without limit all the elements of your employees, unless you decide to destroy them permanently. We advise you however to keep these elements for a period of 5 years + 1 current year (except possible legislation of non conservation of personal data as it is done in Europe with the GDPR (General Data Protection Regulation) implemented since 25/05/2018) and the Data Protection Office in Mauritius.

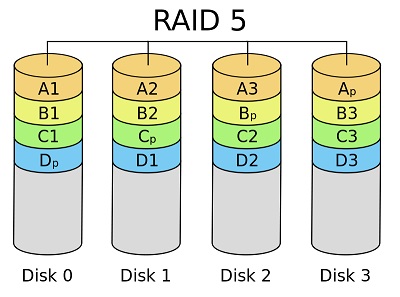

Payroll Mauritius is very vigilant about the security and backup of your data. And not only because it is the very foundation of SaaS (Software as a Service) logic on the Internet.Thus, your data is automatically replicated every day over a period of 7 sliding days at our secure hosting provider. In addition, there is a monthly backup, every month, of these to another

RAID 5 technology server whose location is kept secret.

Your request is legitimate. The answer is multiple. The first point is whether the Internet is reliable in Mauritius. We now believe that this has been done; the many high-speed submarine cables (SAFE®, LION®, IOX® (2019)... and probably later MARS) now protect us from a digital desert. For several years now, the quality but also the speed (constantly increasing) on Internet offered by the large suppliers (My-t®, Emtel®, Bharat Telecom®...) thanks to the optical fiber which democratizes on all the Mauritian territory, guarantee us a resilience of access to Internet at a rate >99%.

This makes the Internet reliable and ensures that you can access it at any time, especially during the payroll period.

The second point is to ensure that access to the Payroll Mauritius service is reliable over time.

For that, Payroll Mauritius chose to host the service at Google®.

This American service and hosting provider is one of the most powerful in the world (over a million servers). To be sure, ask yourself if, since you use computers, you have had, even once, a denial of access to the Google search engine? We are intimately convinced that this hosting provider is one of the most reliable in the world, making the Payroll Mauritius service always (with very few exceptions, and sometimes for 2 hours at night for the necessary backup and reorganization of the data system) accessible for your payroll needs, month after month, year after year.

This American service and hosting provider is one of the most powerful in the world (over a million servers). To be sure, ask yourself if, since you use computers, you have had, even once, a denial of access to the Google search engine? We are intimately convinced that this hosting provider is one of the most reliable in the world, making the Payroll Mauritius service always (with very few exceptions, and sometimes for 2 hours at night for the necessary backup and reorganization of the data system) accessible for your payroll needs, month after month, year after year.

You are right to legitimately question yourself on this point, especially since this has happened until recently, with the piracy of digital information from big bands as (Twitter®, Facebook®, Yahoo®...).

The first part of the answer may seem confusing, but the answer is... you can't be sure.

But just as you can't be sure that your personal computer (whether you think it's safe at home or at your office) isn't hacked by a dishonest hacker on the other side of the world either... As soon as you are "connected" to anything (internet, internal network, bluetooth,...) you are potentially in a position to see your data being hacked.

However, just as you can protect your home from potential thieves with basic means of protection (dog, locked door) up to more developed (intrusion detectors, window bars, alarm connected, CCTV camera...), the only real difference is that Payroll Mauritius implements the protection of your data with the most sophisticated defense systems of the moment... that few individuals or companies have the means to implement... this is the strength of the cloud and the sharing of means!

First of all, Payroll Mauritius' chosen hosting at Google® guarantees the use of the best anti-virus, anti-sniffing, anti-piching and other malware systems that you could not implement on your own local system, Google® infrastructure is protected by more than 700 information, application and network security experts.

Moreover, our databases containing your data are SQL databases that are automatically encrypted with a 128-bit key making intrusion almost improbable, even more difficult for a hacker to exploit.

Finally, identification and access, which are normally the most important weak point regarding the risk of data misappropriation, are managed with the obligation to set up a highly complex password with programmed renewal.

The first element of the answer is the very policy chosen by Payroll Mauritius of no obligation on your part. So, in case of disagreement on anything, you... just stop paying! Moreover, Payroll Mauritius general conditions of sale and use largely frame the possibilities of tariff increase, thus assuring you that a tariff will not be able to double or triple from one year (and still less from one month) on the other! Finally, you can opt, if you wish, and rather than a monthly payment, for a quarterly, annual or tri-annual treatment, guaranteeing you the conservation of the amount of your subscription over the chosen period.

The answer is no. Even if we advise, for large companies, to have a Human Resources (HR) Manager, who is familiar with the particularities of Mauritian payroll, this is not an obligation. With Payroll Mauritius an important part of the payroll complexity is managed by the tool that allows you to be autonomous for calculation, legal declarations and payments. The tool is also a great help for Human Resources Managers who are then, with a tool at the cutting edge of technology, able to manage easily and even for large structures, the payroll of employees.

The longest part of the process will consist of recording absences and overtime. However, whatever system you have at the moment (manual, transmission to a practice or another software or Excel®) it is already time you are used to devote: it will not be extra with Payroll Mauritius. Moreover, if this recording of absences is carried out regularly (see automatically by the input/output devices that we manage and/or by the holiday requests by the mobile application Staff Connect available for employees); if there are no changes to establish then the payroll consists of... starting the automatic calculation, sending the pay slips (automatically by mail or in the employee space or printing them) and sending the declaration file(s)... Then we talk about... a few minutes!

First of all, Payroll Mauritius has already set up the banking formats of the main banks in Mauritius (MCB®, STATE BANK®, ABSA®, BPC®, HSBC® MAUBANK® ...). If unfortunately your bank was not, simply send us an example of the file and possibly a contact to your bank and we will take care of free deploying it as soon as possible!

Since the payroll of September 2020, the software Payroll Mauritius has standard rules to automatically manage these two new deductions wanted by the Government.

Thus for the Employees having an annual income exceeding Rs 3,000,000 (including possible dividends), the Solidarity Levy will be deducted from the salary by the Employer.

In addition, the Contribution Social Generalise (CSG) is deducted in replacement of the contribution to the NPS and for all Employees, without any ceiling.